Dear Oh Dear

You may have seen the footage of a certain high-ranking member of the British Royal Family greet the current Prime Minister this week with the words ‘dear oh dear’.

If you have been following UK politics for the last couple of weeks, then you will sympathize with his words.

I think ‘dear oh dear’ sums up how a lot of people are feeling about a lot of stuff right now.

We have a war, inflation at a 40-year high in the US, interest rates rising, the fear of a recession, stock and bond markets in a mess.

Dear oh dear oh dear.

What can we make of it all?

We can’t forecast the future – no one can. All we have is history to use as a guide. And although it never repeats, it does at least rhyme. Or at the very least, we humans never change our spots.

Over the last 50 years, there have been eleven bear markets (defined as a peak to trough fall in the S&P 500 of 20% or more). We are in the twelfth.

All the Bear Markets since the end of the Second World War, with the last 50 years highlighted.

Three of those saw the market cut in half (highlighted in yellow above). They were true cataclysms.

Let’s go back to what was going on in the world during those three crashes and recount the horror.

Number 1. The 1973-74 crash was a series of economic and political nightmares coming together. Nixon had taken the US off the gold standard, without which inflation was heading higher. There was the Yom Kippur war which resulted in OPEC embargoing the sale of oil to the US and led to oil quadrupling in price, pushing inflation even higher. Nixon was embroiled in the Watergate scandal which led to this implosion of his presidency.

It was a bad time.

Eventually the Fed chairman, Volker, raised interest rates to over 20%, inflation was brought back under control and we had the massive bull market of the 1980s and 1990s.

This then set the stage for Number 2. The 2000-2002 crash.

By the end of 1999 there was a stock market mania, a true mania that had gripped the entire psychology of the United States. Any company with .com in its name was worth millions and everyone wanted a piece as the internet promised to change the world. It went on and on until it popped. The result was that most internet based companies fell 70-90%, many disappeared forever. Amazon fell 94% during that crash.

It was a bad time.

Even the relatively stable, well financed companies of the S&P 500 were marked down by a half.

We then, of course, had Number 3, the Great Financial Crisis. This dwarfed anything we had ever seen before. The entire global economy ceased up and was hanging on by a thread. We went into the deepest and longest recession since the Great Depression. The S&P 500 fell 57% between October 2007 and March 2009.

It was a really bad time.

That’s a 50 year period with three times when, if you had been invested in the 500 biggest companies in the United States, you would have seen your portfolio halve in value.

These were real ‘end of the world’ crises. No one knew how we would get through them.

The only way you could get through them was to maintain faith. You had to have faith in the ultimate resilience of the economy and of the great companies of the US and of the world.

What does a successful business do in hard times?

It lays off staff (have no illusions about that), it closes factories, it sells off marginal business or divisions, it may borrow to get through, the last thing it might do is cut its dividend. Strong companies will grab market share, take on the staff of weaker business, they will innovate.

Ultimately companies take advantage of hard times. They come out of recessions stronger. They aren’t victims, they are opportunists.

If you own the 500 best and biggest companies in the United States, you have 500 highly compensated and competent CEOs and management teams working on getting around the problems they face.

Whilst the price of those businesses goes down, it never stays down. The value is never permanently impaired – how could it be?

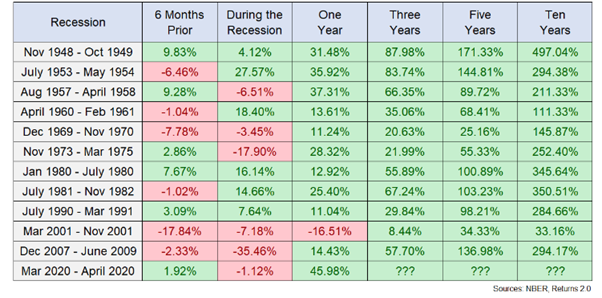

Here are all the recessions since the end of the Second World War. There are twelve of them. We may or may not be in the thirteenth.

Source: Ben Carlson, awealthofcommonsense.com

It doesn’t matter if we are or we aren’t – you can’t know what the economy will do next, it’s far too complex to be boiled down to a model, and even if you did know, you would have no idea what the market would do in response.

The economy cannot be forecast and the market cannot be timed.

The returns running up to the recession and during the recession are random. Sometimes it’s up, sometimes its down.

What is not random is the returns after a recession. There is a lot of green in that chart.

There was a quote on the board of my gym for a while – it said:

‘Don’t get upset by the results you didn’t get with the work you didn’t do.’

If you want those long term results, pay attention to this next bit.

The market is down. It will go back up. Now is the time to invest.

NOW IS THE TIME TO INVEST.

If you have cash in the bank, what are you waiting for? What are you waiting for?

The all-clear?

It won’t come. There is never an all-clear. There is never a bell.

The bottom?

You won’t catch it.

You may live with a little short-term regret if the market continues to go down, but you will avoid the long term regret that comes from looking back and thinking, damn, I wish I had put some money to work then.

Don’t get upset by the results you didn’t get from the work you didn’t do.

As always, you know where we are. Let’s talk it through.

Georgie and Guy

Georgie@libertywealth.ky, Guy@libertywealth.ky